Contents

1.

Rix’s Creek; Bloomfield

eligibility of R&D activities (various elements)

2.

DZXP, KRQD; QJJS

application by a MEC subsidiary

3.

Silver Mines

late applications

4.

JLSP

generating new knowledge through contracted research

5.

Docklands Science Park

substantiation

6.

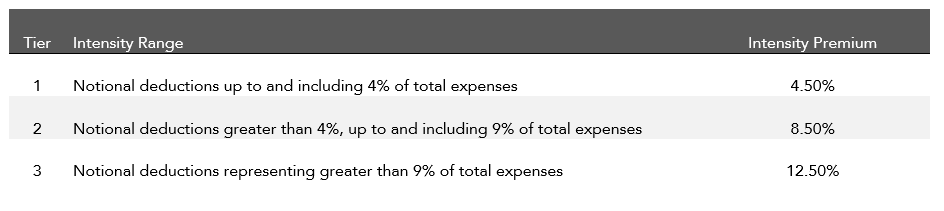

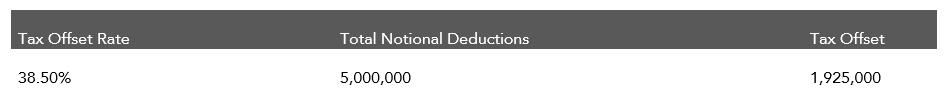

Tier Toys Limited

substantiation

7.

Hadrian Fraval Nominees

substantiation

8.

Mt Owen Pty Ltd

eligibility of R&D activities (various elements)

Rix’s Creek Pty Ltd; Bloomfield Collieries Pty Ltd and Innovation Australia [2017]

Facts

® Applicants applied to overturn a decision disallowing their claims for R&D activities.

® Q: whether claimed activities counted as R&D activities (fell within s.73B of the Income Tax Assessment Act 1936) i.e.

o whether systematic, investigative and experimental;

o whether there was appreciable novelty;

o whether innovative or involving high levels of technical risk;

o whether activities carried on for purpose of new knowledge;

o whether there was sufficient evidence.

Held

® Claimed activities did not count as R&D activities.

1. Understanding the legislation

Ø ‘Systematic, investigative and experimental’ (defined following RACV Sales and Marketing)

o Requirement of detailed documentary evidence as expected feature of activity that is systematic, investigative and experimental (following Docklands Science Park).

Ø ‘Appreciable element of novelty’ (S.73B(2B)(a) ITAA; defined following Explanatory Memorandum 1996 [9.56])

o Requirement that the element of novelty is a “fairly large constituent part of the activity”.

Ø ‘Involving high levels of technical risk’ (s.73B(2B)(b) ITAA)

o Requirement that “the uncertainty of obtaining the technical or scientific outcome can be removed only through that program of activities” (RACV).

Ø ‘For the purpose of acquiring new knowledge [...]’ (defined following Mount Owen Pty Ltd)

o Requirement that new knowledge should not be incidental; claimed activities must be carried on for at least a significant purpose of acquiring new knowledge.

Ø ‘Directly related activities’ (s.73B(1)(B) ITAA)

o Requirement of a direct and close relationship between related activity and carrying on of the core R&D activity.

2. Why were the requirements not met?

Ø ‘DMS Project’

o Requirement of a direct and close or immediate relationship between the related activity and the carrying of core R&D activity.

§ Requirement not met: they only tinkered with the overall design outcome (their claimed core activity was relatively modest and claimed ancillary activities were excessive); there was insufficient evidence provided – no basic records provided e.g. on duration, comparisons, performance, vital data.

Ø ‘Explosives Projects’

o Requirement that the design, development and investigation of the concept was systematic, investigative and experimental.

§ Requirement not met: “a paucity of documentation”; no worked out plan for trial and testing; no detailed plan identifying risks and mitigative measures; no project budget; their “R&D Project Plans” were vague, generalised, undifferentiated, unchronological and unauthored.

o Requirement of innovation or high levels of technical risk.

§ Requirement not met because a “fairly large constituent part of the activity” did not involve novelty.

§ Requirement not met because there was no “significantly greater chance or possibility of failure” compared to the usual case.

o Requirement of purpose of new knowledge.

§ Requirement not met because it was admitted in cross examination that they were “not creating a new product”.

Ø ‘Excavator Projects’

o Requirement that the design, development and investigation of the concept was systematic, investigative and experimental.

§ Requirement not met for similar reasons as Explosives Projects i.e. inadequate recording and documentation; inappropriate methods used; uncontrollable variables.

o Requirement of purpose of new knowledge.

§ Requirement not met because method was considered inappropriate - the claimed activities were incapable of producing meaningful results consistent with the stated hypothesis.

3. Takeaway point

Ø Detailed documentation and recordings are not statutory requirements (at least explicitly), but they may as well be (in connection see Docklands Science Park, Tier Toys and Hadrian Fraval Nominees).

DZXP, KRQD and QJJS and Innovation and Science Australia [2017]

Facts

® Applicants were subsidiaries of a multiple entry consolidated (MEC) group and applied to overturn a decision disallowing their claims for R&D activities.

® Q: whether the Tribunal would review their activities given their subsidiary status.

Held

® Application dismissed for review.

1. Why was the application dismissed?

Ø If you are a subsidiary member of a MEC group, only your head entity can apply for the R&D tax incentive – the applicants were never eligible in the first place.

2. Takeaway point

Ø Take care in filling out the application forms.

Silver Mines [2016]

Facts

® An applicant for the R&D Tax Incentive and Concession was refused on the basis that they did not register their applications within 10 months after the end of their income year.

® Applicant requested review of that decision (they wanted an extension of time of 12 to 14 months to allow their R&D registrations).

® Q: (i) whether late registration could ever be permissible and (ii) whether their late registration was permissible.

Held

® Late registration could be permissible in limited circumstances.

® The applicant’s late registration, however, was impermissible.

1. In what circumstances is late registration permissible?

Ø Late registration is only possible where the action, omission or event causing the applicant's delay is:

o not the responsibility or fault of the applicant; and

o not within the control of the applicant.

Ø The more time an applicant asks for, the greater the requirements are of explanation, evidence and justification.

2. Why did the applicant fail?

Ø The applicant did not take timely and prudent steps to inform itself and progress its registration applications.

Ø The circumstances causing delay were not outside the applicant’s control.

3. Takeaway point

Ø Don’t make a late application. The circumstances in which a late application might be accepted are exceptional, limited and based on discretion.

JLSP [2016]

Facts

® The applicant was carrying out contracted research for a company X (all data/knowledge generated and rights therein belonged to X under the contract).

® The applicant requested review of a decision which determined that their research activities under their contract were not eligible as core R&D activities.

o The applicant was refused because it was held the applicant’s substantial purpose was not generating new knowledge but fulfilling its contractual obligations.

® Q: whether a company carrying out research under a contract for another company could say it has a substantial purpose of generating new knowledge.

Held

® The applicant’s request for review succeeded.

® A company carrying out contracted research can still make a valid claim if it can substantiate that that the company itself holds a substantial purpose of generating new knowledge.

1. How is ‘purpose’ interpreted (s.355-25 ITAA)?

Ø The purpose of generating new knowledge does not have to be the purpose that outweighs all the others.

Ø It has to more than an insubstantial purpose; substantial enough to enable the activity to be accurately characterised as conducted for that purpose.

Ø The purpose of generating new knowledge may be a substantial purpose even if at the same time other substantial purposes also exist.

Ø The fact that an alternative purpose for the activity may be identified as a substantial purpose does not automatically negate the purpose of generating new knowledge as a substantial purpose.

2. Does it matter that the applicant itself will never have use of the new knowledge generated?

Ø No.

3. Takeaway point

Ø It is enough that the core activity satisfies the definition of “core R&D activities” in s 355-25(1) of the ITAA (where ‘purpose’ is not interpreted too restrictively); the question of whether tax offsets are available or not is irrelevant in determining the matter.

Docklands Science Park [2015]

Facts

® Applicant requested a review of a decision which found that its registered activities were not eligible R&D activities.

Held

® Applicant failed.

1. Why did the applicant fail?

Ø In summary: “Common to all the activities claimed by Docklands Science Park, there is scant documentation which points to that entity having conducted any activities at all let alone proceeding to conduct core R&D activities in the manner required by s. 355-25(1) of ITAA”.

2. Takeaway point

Ø Detailed documentation, recording the process of each activity as it develops, is necessary to:

o substantiate that the activity took place; and

o establish that the activity meets the legislative eligibility requirements of the R&D Tax Incentive scheme.

Tier Toys Limited [2014]

Facts

® Applicant requested a review of a finding that it was not entitled to the R&D tax offset.

® Q: whether the applicant proved on the balance of probabilities that its claimed expenditure was “directly in respect of” eligible R&D activities for the purposes of s 73B(1) and (14) of the ITAA 1936.

Held

® Applicant failed.

1. Why did the applicant fail?

Ø The relevant records were missing and were not available as evidence of their R&D expenditure.

Ø The Tribunal referred to

o Chapter C1-7 of the Australian Taxation Office's "Guide to the R&D Tax Concession" which says companies should maintain adequate contemporaneous records on claimed R&D activities and related incurred expenditure; and

o s.262A of the ITAA which requires records to be kept "that record and explain all transactions and other acts” relevant to the ITAA.

2. Takeaway point

Ø Records must:

o be detailed enough to distinguish between charges associated with eligible and ineligible R&D activities (through reasonable methods);

o verify the nature, amount and relationship of the expenditure incurred on R&D activities;

o show how expenditure was apportioned between eligible core and supporting R&D activities as opposed to other non-R&D activities; and

o be generally kept for a minimum of five years.

Hadrian Fraval Nominees [2013]

Facts

® Applicant requested review of a finding that it was not entitled to a R&D Tax Concession claim.

Held

® Applicant failed.

1. Why did the applicant fail?

Ø Applicant could not substantiate the claimed expenditure.

Ø It did not take reasonable care to account for the R&D expenditure it incurred in relation to materials, licence fees and consultancy services.

2. Takeaway point

Ø Companies must maintain adequate records to substantiate the R&D activities claimed and the incurring of expenditure in relation to those activities.

Mt Owen Pty Ltd [2013]

Facts

® Applicant requested review of a finding that some of its activities were not R&D activities as defined in s.73B(1) of the ITAA.

Held

® None of the applicant’s claims were accepted as being R&D activities.

1. What were the main issues with the applicant’s claim?

Ø Routine tests and common activities conducted in a complex environment are not, on their own, R&D activities – there must be evidence of a new or different approach to resolving issues.

Ø There must be credible evidence of the purpose of conducting the activities and the existence of a hypothesis.

Ø Where existing technologies are being combined in a new way, they must be used in an inter-related manner that generates some uncertainty in their combined effect.

Ø Geology, safety, operational, production, economic and other commercial risks do not demonstrate technical risk – the technical risk must be from the substance of the experiment itself, and not the wider risks of the company's operations.

Ø A specific hypothesis must form the basis for specific experimental activities (not vague & overarching).

Ø Aggregation/disaggregation of activities – the applicant must:

o identify and describe what was done in the activities; and

o explain how activities collectively satisfy the definition if some or all of the activities don't individually.

2. Takeaway point(s)

Ø We have to identify:

o What the activities involve;

o A systematic progression of work with a genuine, specific hypothesis which was subsequently investigated in an experiment;

o A new or different technical or scientific idea or proposition; and

o Whether the generation of new knowledge is at least a significant purpose of the claimed core activity.