A QUICK RECAP:

The proposed changes to the R&D Tax Incentive (RDTI) will significantly impact large companies looking to make a claim, i.e. companies with > $20 million aggregated turnover. The key changes to note are the following:

· Notional deductions capped at $150 million,

· Large R&D entities are entitled to an R&D tax offset equal to their corporate tax rate plus a premium based on the level of their incremental R&D intensity for their R&D expenditure.

By large, the change reduces the benefit for most companies, and significantly complicates the process.

Below we detail the concepts of R&D Intensity and Intensity Premiums.

R&D INTENSITY:

The R&D intensity is the proportion of the R&D entity’s total expenses spent on R&D expenditure for the income year:

R&D Intensity = (Notional Deductions ÷ Total Expenditure)

Notional deductions relate to expenditure on R&D activities and depreciation on assets held for R&D purposes.

Total expenditure relates to the entity’s total expenses reported in their company tax return. The expenses reported at item six of a company’s income tax return are the expense amounts taken from the company’s financial statements.

INTENSITY PREMIUMS:

As mentioned, large entities are entitled to an R&D tax offset made up of two components:

R&D Tax Offset = Corporate tax rate + Intensity premium

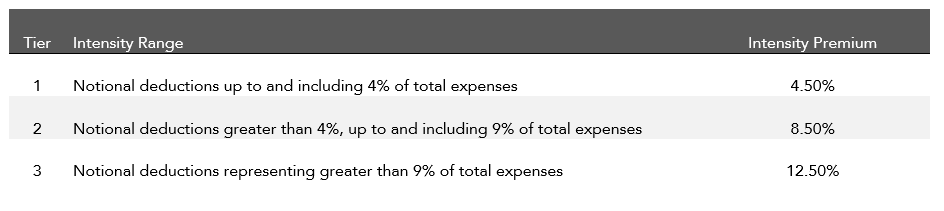

These intensity premiums will be determined cumulatively by the entity’s R&D intensity rate as follows:

WORKED EXAMPLE:

Company A has notional deductions of $5 million for the 2018-2019 income year. They also had $63 million worth of total expenses. Its aggregated turnover exceeds $50 million, meaning it is subject to the 30% company tax rate.

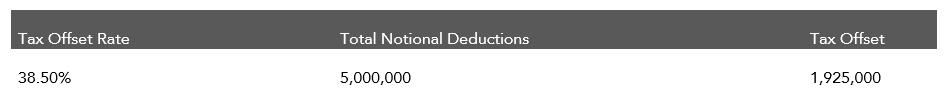

Under the current R&D Tax Incentive scheme:

The tax offset would be calculated by simply multiplying notional deductions by the current 38.5% rate for large entities:

The net benefit would be 8.5% of the R&D spend/notional deduction under the current scheme.

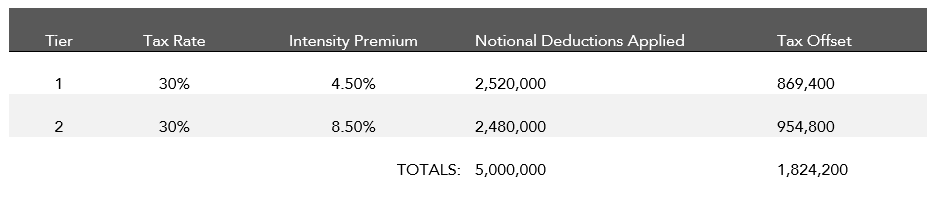

Under the proposed R&D Tax Incentive scheme:

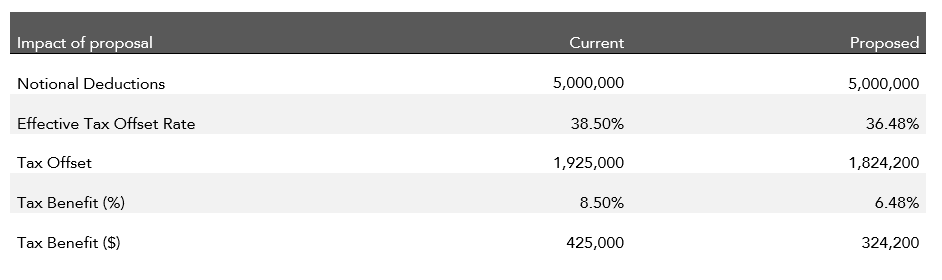

Comparing the benefit:

THE MAIN POINT:

Introducing progressive rates to the RDTI based on R&D intensity, will effectively reduce Company A’s overall tax benefit by approximately $100k. Instead of getting a tax benefit of 8.5%, company A will now only receive a 6.48% tax benefit under the proposed scheme. Moreover, if Company A wanted to continue accessing a tax benefit of 8.5%, they would need to increase their R&D intensity to 13%. Lastly, even if Company A increased their R&D intensity to 100%, the maximum benefit they could access is 12% due to the sliding scale.

The majority of large companies will struggle to continue accessing the current 8.5% tax benefit, as most companies have an R&D intensity between 0-4%, Therefore they will only be eligible for the 4.5% tier 1 tax benefit moving forward. Given this, many large companies may consider that the RDTI is unviable if the proposed changes were to take take effect.